From Sands to Science: Will Riyadh Rise as the Global Biotech Hub?

Recognizing the transformative potential of life sciences, Saudi Arabia embarks on ambitious initiatives to cultivate a thriving domestic industry, aiming to improve healthcare, diversify the economy, and address global challenges.

Saudi Arabia’s new gold rush is in gene sequencing, not oil rigs. Can Riyadh, once synonymous with fossil fuels, transform into the Boston of the Middle East, or even a global biotech powerhouse? The Kingdom’s ambitious Vision 2030 is betting billions on this audacious leap. Dive into the text as it unfolds, exploring the compelling case for Saudi Arabia’s life sciences upward movement; a booming market fueled by oil wealth, government dedication (17% budget allocation for healthcare and life science), and cutting-edge tech initiatives like “Wasfaty” boosting healthcare accessibility. The potential is undeniable. Saudi Arabia’s embrace of biotechnology extends beyond healthcare, encompassing food production, environmental protection, and even industrial growth. Strategic partnerships, dedicated infrastructure, and a focus on R&D ensures a promising picture. However, questions remain. Can Riyadh attract and retain top talent? Can it overcome cultural and regulatory hurdles?

And is the infrastructure robust enough to support a truly global hub? Only time will tell if Riyadh comes to fruition for its biotech ambitions will help it achieve it into a global phenomenon. But one thing is certain: the sands are shifting, and the world is watching!

From Labs to Leaders: How Boston became a Hub for Medical Innovation

Achievements

- Became the world’s leading biotech hub with a high concentration of biotech and pharmaceutical companies.

- Fostered a strong ecosystem for talent development and research collaboration.

- Attracted significant venture capital funding for biotech companies.

- Produced groundbreaking advancements in medical research and disease treatment.

From Imports to Innovation

How Saudi is working to build a biotech Hub

Saudi Arabia has rapidly transformed from basic healthcare provision to a regional biotech leader in recent years through initiatives like Vision 2030, Health Sector Transformation Program, National Biotechnology Strategy, and other initiatives.

Boston and Riyadh, separated by continents and cultures, are both emerging as pivotal players in the global biotech scene. However, their journeys toward this shared destination show contrasting pictures. Boston, a seasoned pioneer, boasts a rich biotech legacy dating back to the 1970s. Renowned academic institutions like MIT and Harvard, coupled with venture capital giants and established pharmaceutical companies, have formed a fertile ground for innovation and transformation. This ecosystem thrives on a mature infrastructure, extensive talent pool, and a collaborative spirit nurtured over decades. Riyadh, a rising challenger, presents a starkly different landscape. Its biotech ambitions are relatively young, fueled by the transformative Vision 2030 initiative. The kingdom is pouring significant investments into building research facilities, attracting global talent, and fostering local entrepreneurship. Whilst lacking the historical depth of Boston, Riyadh compensates with audacious goals, strong government backing, and a willingness to disrupt traditional growth and development models.

| Date | Milestones | |

| Early Beginnings (Pre-2000s) |

|

|

| Building the foundation (2000s) | 2022 | King Abdullah University of Science and Technology (KAUST) established, fostering research in biosciences and biotechnology |

| 2003 | King Abdulaziz City for Science and Technology (KACST) launches biotechnology programs, including research grants and incubator initiatives | |

| 2008 | King Fahad Medical City establishes a dedicated biotechnology department | |

| 2010 | Growth of scientific research institutes and hospitals involved in biotechnology | |

| 2013 | Launch of the National Transformation Plan, emphasizing diversification and investment in technology sectors like healthcare and biotechnology | |

| Vision 2030 and Rapid Growth (2020s) | 2016 | Vision 2030 announced, including ambitious goals for healthcare and biotechnology development |

| 2017 | Establishment of the Ministry of Investment to attract foreign investment in strategic sectors like biotechnology | |

| 2018 | Launch of the "Bio City" project in Jeddah, aiming to become a regional hub for biotechnology innovation | |

| 2019 | Signing of memorandums of understanding (MoUs) with global pharmaceutical companies like AstraZeneca and GlaxoSmithKline for local manufacturing and knowledge transfer | |

| 2020 | Ministry of Health unveils a five-year e-health strategy to improve healthcare delivery through digitalization | |

| 2021 | Local production of pharmaceutical end-products reaches ~36% aiming to achieve 40% by 2030 | |

| 2023 | Ongoing investments in vaccine and insulin production facilities, plasma collection centers, and advanced medical technologies | |

| 2024 | Launching the National Biotechnology Strategy which aims to position Saudi Arabia as a biotech leader in MENA by 2030 & globally by 2040 |

As Saudi Arabia charts a course to become a leading global biotech hub, the Kingdom’s policymakers are casting a keen eye towards established leaders in the field. Boston’s rich history of innovation and supportive ecosystem serves as a valuable case study, offering insights into the milestones, achievements, and challenges that shaped a world-renowned life sciences cluster. By understanding Boston’s journey, Saudi Arabia developed a vision and accompanying strategies to cultivate a thriving domestic biotech, healthcare and life sciences sectors.

Saudi’s Vision for Healthcare & Life Science

Saudi Arabia, through Vision 2030 Health Program, is building a future of accessible, tech-driven healthcare empowered by a bold biotech strategy, aiming to be a regional leader and global contributor.

1. Saudi Arabia’s Healthcare Transformation: A Multifaceted Approach – 2021

Under Vision 2030, the Health Sector Transformation Program (HSTP) is revolutionizing healthcare in the Kingdom. Its core objectives revolve around creating a comprehensive, effective, and integrated system. This translates to improved access for all, modernized facilities and equipment, and a focus on preventive care through public health awareness campaigns. Additionally, the program leverages technology by expanding e-health services and data-driven solutions, aiming for financial sustainability and adherence to international standards. This robust system proved its mettle during the COVID-19 pandemic, demonstrating the program’s adaptability and effectiveness.

2. Biotechnology: Fueling the Future of Healthcare & Life Science – 2024

Complementing the transformation program is the dedicated National Biotechnology Strategy. Recognizing its potential to revolutionize medicine and healthcare, Saudi Arabia is actively fostering a thriving biotech ecosystem. The strategy focuses on attracting global investment, promoting research and development, and nurturing local talent. This includes establishing specialized research facilities, incubators, and accelerators, along with creating a regulatory framework conducive to innovation. By prioritizing areas like gene therapy, personalized medicine, and biomanufacturing, the Kingdom aims to become a regional leader in the biotech sector, not only improving healthcare for its citizens but also contributing to global advancements in this dynamic field.

| Strategies for Healthcare & Life Science | Health Sector Transformation Program | National Biotechnology Strategy |

|---|---|---|

| Main Objectives |

|

|

| Saudi Arabia Challenges to be Addressed |

|

|

| Ambitions and Targets |

|

|

| Initiatives Used to Achieve Objectives & Ambitions |

|

|

KSA’s Healthcare & Biotech Ecosystem

Fueled by healthcare needs, government commitment, and biotech innovation, Saudi Arabia’s healthcare sector is booming, with biotechnology leading the charge towards a self-sufficient and cutting-edge future.

Saudi’s Healthcare & Life Science Current Ecosystem

The Saudi healthcare ecosystem is undergoing a dynamic transformation, with ambitions to become a global hub by 2040. While heavily reliant on imports currently, the Kingdom boasts significant investments in pharmaceuticals, medical devices, and biotechnology, aiming to bridge the gap and build localized expertise. Key drivers include growing healthcare expenditures, government initiatives like Vision 2030, and a burgeoning startup scene focused on healthtech innovations. However, challenges remain, such as attracting top talent, fostering a robust research environment, and ensuring regulatory alignment with international standards. Whether Saudi Arabia can effectively navigate these hurdles and achieve its ambitious goal by 2040 remains to be seen, but the ongoing developments suggest a promising future for healthcare innovation in the region. But just how promising? Which specific developments and initiatives are shaping this ecosystem, and who are the key stakeholders driving its transformation? Delving deeper into these details will shed light on the feasibility of Saudi Arabia’s healthcare ambitions and its potential impact on the global landscape.

1. Healthcare Current Ecosystem

Manpower

KSA’s healthcare system has witnessed a remarkable nationalization drive between 2018 and 2022. While the overall workforce grew by 17.7%, the reliance on non-Saudi professionals across critical roles like physicians and pharmacists significantly decreased. Physicians saw a particularly impressive shift, with Saudi representation jumping by 14.8%, effectively reversing the earlier non-Saudi majority. This trend extends to nurses and pharmacists, demonstrating a concerted effort to empower Saudi nationals within the healthcare sector. This nationalization push signifies a strategic investment in KSA’s healthcare future, potentially leading to greater autonomy and resilience in the long run.

Facilities

While a slight decrease of 0.71% in hospital beds per 10,000 people is observed, it serves as a valuable indicator to proactively address future healthcare infrastructure needs. Recognizing the projected population growth and requirement for at least 7,500 additional beds by 2030, Saudi Arabia has an exciting opportunity to further strengthen its healthcare system through strategic infrastructure investments.

| 2018 | 2022 | CAGR (2018-2022) | |

|---|---|---|---|

| Number of Ministry of Health Hospitals | 284 | 287 | 0.26% |

| Number of Other Governmental sector Hospitals | 47 | 52 | 2.56% |

| Number of Private Sector Hospitals | 163 | 154 | -1.41% |

| Number of Hospital Beds | 75,225 | 78,440 | 1.05% |

| Recent Advancements | Date | Objective | Stakeholders Involved | Project Description |

|---|---|---|---|---|

|

2024 |

Healthcare Advancements & Improvements | Open Medical with MoH(KSA)- Farouk Maamoun & Tamer Co. | Piloting a program to streamline surgical care and reduce wait times in the Kingdom |

|

2023 |

Healthcare Advancements, Investments & Improvements | Cerba HealthCare and Nexus Gulf Healthcare | Create a new company offering top-notch diagnostic tools in Saudi Arabia, especially in clinical pathology – HQ in Riyadh |

Interview

Saudi Arabia and the Promising Landscape of Clinical Trials and Biotech Companies With Market Interest and Regulatory Challenges as the Main Hurdles of Success.

Martine Abi-Khalil is the CEO of KBP-Biomak. KBP-Biomak is a full-service Contract Research Organization (CRO) and healthcare consulting company operating in the MENA region with focus on clinical trials and operations, pharmacovigilance as well as patient support programs, quality management system, training, market access and healthcare strategy projects .KBP-Biomak has full integration with ICH/ GxPs in addition to regional regulatory requirements in countries they operate in.

Martine Abi-Khalil is the CEO of KBP-Biomak. KBP-Biomak is a full-service Contract Research Organization (CRO) and healthcare consulting company operating in the MENA region with focus on clinical trials and operations, pharmacovigilance as well as patient support programs, quality management system, training, market access and healthcare strategy projects .KBP-Biomak has full integration with ICH/ GxPs in addition to regional regulatory requirements in countries they operate in.

Martine is a clinical research and healthcare expert and certified GSDP (Good Storage and Distribution Practices) auditor with focus on health management and quality management consulting. She holds a BA in Biology and Master in Industrial Technology from Saint Joseph University, an MBA and Master’s in Management form ESCP and ESA business school and an Executive Master’s in Health Management from Université Paris Cité and ESA business school.

Q: Which government initiatives or policies are currently impacting the industry, and how are they expected to influence future growth?

A: The Saudi Goverment is attracting foreign companies including Americans ones to promote innovative medications for rare, chronic, oncology diseases. The SFDA is also making the approvals much easier for such biotech companies to sell their treatments in KSA to allow patients having access to such innovative products in a fast way. There is also a vision of increasing production locally including of new and innovative products, so the country can become self-sufficient. Vision 2030 is the main driver behind the growth opportunities as there is a big chance in 5-10 years to have a huge biotech market.

Q: How is the regulatory environment for clinical trials evolving in KSA?

A: For clinical trials, companies are very interested in KSA market for conducting clinical trials as there is a big potential in terms of number of patients, growing population, presence of rare diseases, high prevalence of chronic diseases (mainly obesity, diabetes...) and of course due to the incentives of Vision 2030. Also SFDA is now obliging companies to conduct certain clinical trials to support the registration of drugs, the follow up on already registered ones or for confirming certain aspects the company is declaring about. In terms of regulations, the SFDA is the responsible entity for setting the regulations for clinical trials and is considered one of the best in the region in terms of laws, regulations, governance and control. However, some challenges exist; for example the fact that as each hospital sets its own process for approving the trials and pricing. The regulatory submission pricing varies hugely, and this makes it complicated. There is no central IRB, and this is very challenging for observational studies. However, the SFDA is trying to work on this and is listening to the marketplace about such issues including issues related to struggle of long processes and long approval timelines, uniformity of the approvals across the kingdom, fees...

Q: What advice would you give to companies considering conducting clinical trials in KSA?

A: The most important thing is to have a local company and local presence otherwise submissions to regulatory authorities (SFDA) and IRBs will not be possible. The company should also have dedicated team members who are highly knowledgeable of the KSA market and that have inner connections and business relations with the hospitals.

Also it is important to note that the MENA region has one of the lowest numbers of clinical trials compared to other countries and regions; even though it’s a region with a very big potential for trials due to the presence of a lot of diseases like sickle cell and Thalassemia as well as obesity and cardiovascular in KSA; also the presence of rare diseases.. But also MENA region has a lot of treatment naive patients that is a good population for clinical trials. So pharmaceutical companies really need to consider this part of the world more into their research programs as it has a lot to offer in terms of population, medical and para medical resources, equipped hospitals and centers, culture, language....

Q: How can companies leverage the KSA Vision 2030 goals to gain a competitive advantage in the biotech and healthcare sector?

A: If you want to work with the government which is the bigger client (bigger than private sector), you need to be there to leverage such incentives and even the HQ must be in KSA. But at the same time the infrastructure has vastly improved. Many hospitals are being transformed into high quality hospitals. Moreover, they are working on health tourism. KSA has a huge potential given that their centers are already equipped with best equipment. However, they are still not the main attraction center, yet.

Q: Can Saudi Arabia become a global biotechnology hub by 2040?

A: Yes, I believe KSA has a high potential to become the next Boston. Logically, the financing is abundant and will never be an issue as biotech is research heavy and the most critical success factor for research is financing and investments. The knowledge and know-how are also being transferred from abroad to KSA given the huge incentives via Vision 2030. And given that the talent is also improving then all conditions are there to become the next hub. USA now is the leading hub of biotech, however KSA can reach to those levels especially given the huge ambitions of ‘The Crown Prince’ and his overall direction for the country.

2. Pharmaceutical Current Ecosystem

KSA’s pharma market represents an attractive business landscape that is driving international investment by pharma companies in Saudi Arabia. Saudi Arabia’s strategic location and strong logistics infrastructure makes it an attractive base for pharma companies looking to expand their presence in the wider MENA region.

Moreover, several multinational pharmaceutical companies have established a presence in Saudi Arabia, either through direct investment or partnerships with local companies. These companies include Novartis, Pfizer, Sanofi, Merck, and GlaxoSmithKline, among others.

| Recent Advancements | Date | Objective | Stakeholders Involved | Project Description |

|---|---|---|---|---|

|

2024 |

Localizing Pharmaceutical manufacturing | Jamjoom Pharma, MSD, and Local Content Government Procurement Authority (LCGPA) | Signed contracts to produce sitagliptin phosphate, a medication used to treat type II diabetes |

|

2023 |

Investing and localizing pharmaceutical manufacturing | Avalon Pharmaceuticals | Anticipated to launch by 2026, Avalon 4 (USD 27.6 Mn plant) will be located in the industrial city in Riyadh and will focus on different forms of complex and high-tech medications such as oncology and general injectables |

|

2022 |

Localizing Pharmaceutical manufacturing | NUPCO - Sudair Pharmaceutical Co. - Sanofi | Singed a preliminary agreement with Sudair Pharmaceutical Co. and Sanofi, to localize the insulin industry in the Kingdom |

Interview

The Rapid Transformation of Saudi Arabia’s Pharmaceuticals Industry and How Can Market Research and R&D Change the Competitive Landscape of Pharmaceutical Manufacturing in the Kingdom.

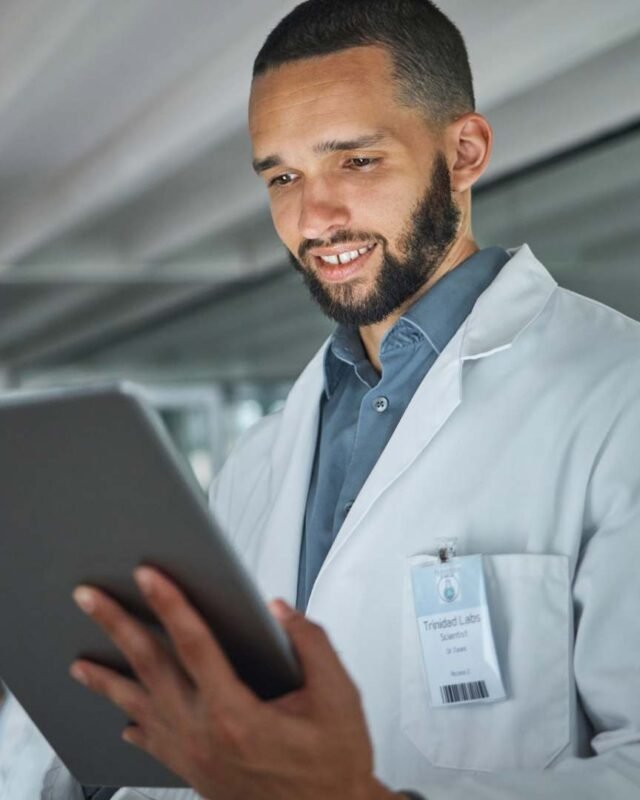

Mohamed Ismail is the regional group product manager for Jamjoom Pharma. Jamjoom Pharma is one of the leading pharmaceutical companies in the Afrasia region. The geographical focus of the company is on countries in the Middle East, Africa, and CIS regions. The manufacturing facilities and head office are in the port city of Jeddah in Saudi Arabia.

Mohamed Ismail is the regional group product manager for Jamjoom Pharma. Jamjoom Pharma is one of the leading pharmaceutical companies in the Afrasia region. The geographical focus of the company is on countries in the Middle East, Africa, and CIS regions. The manufacturing facilities and head office are in the port city of Jeddah in Saudi Arabia.

Mohamed is a leading product management professional with an MBA from the International Business Academy of Switzerland and has a Global Business Diploma focused on marketing from ESLSCA. He drives regional sales growth for Jamjoom Pharma for a designated portfolio of pharmaceuticals.

Q: How is the KSA healthcare system attracting and retaining skilled talent in the biotech and healthcare fields?

A: Before, the recent KSA transformation’s which happened after 2017-2018, the go strategy was to get skilled labour and cadres from EU and USA, due to shortage in the national talents at that time, and this was done in both private and public sectors. After 2018, the go strategy for the government is to offer scholarships, programs and financial aid in prestigious universities in EU and USA to develop national talent and capabilities abroad and then to utilize them in KSA. The good thing is that the mindset of young Saudis has changed a lot and most of young Saudis today are very ambitious and love to actually serve and contribute to their country instead on relying on governmental support which means at one point KSA will not need to rely on foreign skilled labor but job market will become a very competitive one similar to what we see in EU and USA

Q: What are the key considerations for companies looking to establish a research and development presence in KSA?

A: R&D success is a combination of talent which KSA shortage, and resources/funding which KSA definitely doesn’t lack. However, a key consideration is that R&D usually requires collaboration with educational institutions. R&D needs universities especially in drugs and biotech that’s why you see most US and EU drug companies very successful in R&D since they leverage the top universities in their countries. So, for companies in KSA, they need to first make sure they have a very skilled in-house R&D team, a dedicated budget that is not trivial form their revenues hence commitment and finally a good partnership with a top university in KSA (could be US university or local one).

Q: What advice would you give to companies considering participating in clinical trials in KSA or pharmaceutical manufacturing?

A: For pharmaceutical manufacturers to enter the market, they really do need to spend a lot of time and resources on market research and benchmarking. You can’t simply just enter the market and hope for the best. The company needs to find a gap that is underserved or that the competitors still lack the know-how in KSA. If you go into cardiovascular and diabetes you are most likely to fail unless you had a huge R&D breakthrough and were able to get governmental contracts which is unlikely. Oncology and rare diseases are the segments where I see true potential. But still you need to understand your competitors and benchmark them to what you have because you need to be differentiated. Hence, don’t opt to a highly competitive and fragmented segment but go for a segment that you can capture. The mode of entry for pharmaceutical production can be either via franchising or selling the patent as building the factories is expensive but still if you have the resources then it is a good opportunity. For medical devices, partnership with original producers and just work on final assembly and packaging here since the hospitals and medical device distributors usually work with a select number of international brands.

Q: Can Saudi Arabia become a global biotechnology hub by 2040?

A: Yes, I truly believe that KSA can become the GCC and MENA hub by 2030 and if things keeping growing as is yes KSA can become the next global hub. You have the right infrastructure and government spending will remain the true driver behind the growth. However, the changing mindset and collective effort of Saudis towards transforming the kingdom into a global leader is what will try make KSA the ultimate hub. And not only that, I can see in the future when the local companies start spending on R&D and become mature enough to the point that their product quality will rival and surpass those of the EU and US companies, then by that KSA will become the global leader as KSA companies at that point will stop relying on imports and international brands and will start acquiring foreign MNCs and entering markets internationally to reach the true definition of global leadership in this domain.

3. Medical Devices Current Ecosystem

While being a major player in the Middle East’s healthcare landscape, Saudi Arabia is also seeking to develop its medical devices market. The current medical devices market in KSA is estimated at around 6.3 Bn USD and it is expected to grow to 8.5 Bn USD in 2028 at a 5.9% growth rate. Currently the market is heavily import dependent with players like Siemens Healthineers, GE and Boston Scientific dominating the market. Nonetheless, the government and authorities are continuously refining the Kingdom’s medical device regulatory framework to ensure patient safety and foster industry growth. The country boasts a comprehensive system overseen by the Saudi Food and Drug Authority (SFDA), aligning with international standards for medical device registration, import, and distribution. However, keeping pace with rapid technological advancements in areas like AI, biotech, and digital health necessitates further regulatory adjustments. SFDA, emphasizes the need to embrace these advancements by developing robust standards for AI integration, medical device maintenance practices, and medical gas systems.

Key Drivers of KSA Medical Device Market Development

- Increasing prevalence of chronic diseases: As the population ages and lifestyle factors change, the demand for accurate diagnosis tools grows.

- Advancements in Standards: There is an overall push towards excellence in medical services which is backed-up by the availability of funding.

- Rising healthcare expenditure: Increased government and personal spending on healthcare fuels market growth.

- Increased focus on preventative healthcare: A growing mindset change over the past decade as patients are becoming proactive rather than reactive.

- Remote imaging and telemedicine: Vision 2030 and the HSTP program promote accessible healthcare through these innovative approaches.

With a focus on innovation and accessibility, the Saudi Arabian diagnostic imaging market holds promise for revolutionizing healthcare in the region and beyond.

Major players like GE, Siemens Healthineers, Philips Healthcare, and Canon Medical Systems capitalize on the markets potential mainly via their local partner distributors. The imported medical devices are mainly the advanced ones with the local manufactured supply from players like Jamjom Medical Solutions and Enayah mainly being basic medical device applications.

| Recent Advancements | Date | Objective | Stakeholders Involved | Project Description |

|---|---|---|---|---|

|

2023 |

Medical Devices recent advancements | MoH (KSA) – Altakassusi Alliance Medical | MoH awarded one of the Kingdom’s first public- private partnerships (PPP) in the healthcare sector to Altakassusi Alliance Medical. The latter will be responsible for managing patient services in the hospitals’ radiology and nuclear medicine departments including King Fahad Medical City hospital |

|

2022 |

Localize Pharmaceutical manufacturing | Nahdi Medical Company & Al- Teriaq Pharma | Signed MoU to support the localization of pharmaceutical production and medical supplies |

4. Biotech Current Ecosystem

Despite its global potential, the Middle East lacks a top-tier biotech hub. Nonetheless, Saudi Arabia is aiming to build a leading and competitive biotech ecosystem both regionally and globally. One of the key initiatives driving this ambition is The National Biotechnology Strategy that streamlines regulations, and the National Committee for Bioethics updates guidelines.

Biotech-focused programs like Dammam Valley’s startup program show further traction and initial efforts are underway to unite the Saudi biotech sector. Major governmental institutions have invested in infrastructure, labs, and initiatives like the Saudi Human Genome Program.

These encourage private sector involvement, support researchers, and promote commercialization. While initial efforts have laid the foundations to develop this ambition, Saudi Arabia needs further action to truly flourish as a global biotech hub.

| Recent Advancements | Date | Objective | Stakeholders Involved | Project Description |

|---|---|---|---|---|

|

2023 |

Localizing & Knowledge sharing for vaccine manufacturing | Saudi Authority for Industrial Cities and Technology Zones “MODON”, and the South Korean GL Rapha Holding Company | Signed a MoU allocating $199 million and 51,000 square meters in Saudi Arabia for a joint vaccine and biotechnology venture |

|

2023 |

Retain talents in the biotech industry | Dammam Valley Imman ABDUL Rahman bin Faisul University, Saudi Aramco, relevant government ministries, and Sadara Petrochemical Company | Launched the BioTech Startups Program to foster the development of the biotechnology sector in Saudi Arabia |

|

2022 |

Increase knowledge sharing, talent, and R&D | Saudi Arabia’s Ministry of Investment Boehringer Ingelheim, Novo Nordisk, and KAUST | Signed MoUs to boost local biotech and medical collaboration, knowledge transfer, and industry localization, ultimately improving public health and quality of life through research centers and awareness initiative |

Main Regulators and Regulations for the Life Science and Healthcare Industry

Having examined the current state of the healthcare and life science sector, it is important to understand the key stakeholder map across the life sciences, healthcare and biotech spaces. KSA has focused on developing and reforming institutions to accelerate its transformation goals.

The life science and healthcare industry is directly regulated by entities like the Ministry of Health and the Saudi Food and Drug Authority, while also facing some additional governance and regulations from other Ministries such as Environment, Water and Agriculture and the Saudi Arabian General Investment Authority.

Main Regulators

| Governmental Agency Or Body | Sector | Role |

|---|---|---|

|

Healthcare, Pharma, & Biotechnology | Oversees public healthcare, sets health policies, regulates medical services, and manages hospitals and clinics throughout the Kingdom |

|

Healthcare & Biotechnology | Ensures the safety, quality, and efficacy of food, drugs, medical devices, and cosmetics in Saudi Arabia Regulates the price and registration of drugs and medications |

|

Healthcare | Licenses and regulates healthcare professionals, sets accreditation standards for medical education and training, and oversees continuing professional development |

|

Healthcare & Pharma | Regulates the health insurance market in Saudi Arabia, sets standards for insurance plans, and promotes access to affordable healthcare |

|

Healthcare | Acts as a conductor, orchestrating collaboration between healthcare entities to improve regulations, research, and ultimately, health outcomes across the Kingdom |

|

Healthcare, Pharma, & Biotechnology | Invests in strategic sectors to diversify the Saudi economy, including healthcare. PIF supports healthcare projects through funding, partnerships, and infrastructure development |

|

Healthcare, Pharma, & Biotechnology | Promotes foreign direct investment and facilitates business establishment in Saudi Arabia, including the healthcare sector. MISA provides support and guidance to healthcare investors |

|

Healthcare & Pharma | Centralizes the procurement of medical supplies and equipment for public healthcare facilities, aiming for cost efficiency and transparency |

|

Healthcare, Pharma, & Biotechnology | Encourages and promotes the use of locally manufactured products and services in government procurement, including healthcare projects |

|

Healthcare & Pharma | Provides information technology solutions and infrastructure for government agencies, including healthcare institutions, to improve efficiency and service delivery |

|

Biotechnology | Supports the development of the Saudi industrial sector, including the medical device and pharmaceutical industries |

|

Biotechnology | Ensures environmental sustainability and protects public health through regulations and initiatives related to food safety and water quality |

|

Biotechnology | Promotes research and development in various sectors, including healthcare, to drive innovation and technological advancement in the Kingdom |

|

Healthcare & Pharma | Regulates the health insurance market in Saudi Arabia, sets standards for insurance plans, and promotes access to affordable healthcare |

Recent Incentives/Regulations

Given the critical role of Saudi regulatory bodies in overseeing the healthcare and life science landscape, successful implementation of this strategy hinges on close collaboration and addressing potential regulatory difficulties. Below is a list of key regulations that promote foreign investments in the healthcare and life science industries in Saudi Arabia.

| Scope | Regulation / Decree Number or Date of document Publication | Brief Description |

|---|---|---|

| Develop 100% Ownership | Royal Decree number (M/108) of 2020 | The restrictions on foreign ownership of certain pharmaceutical businesses have been removed, consequently allowing foreign investors to directly own any of the specified pharmaceutical businesses in Saudi Arabia. In addition, the new regulation dispensed with certain “localization” requirements, which existed in the "old" Pharmaceutical Law. For example, this law had required pharmaceutical wholesale warehouses to be managed by a licensed pharmacist who is a Saudi Arabian national. Such requirement no longer exists under the new regulation. |

| SFDA Pricing Guidelines 2021 | SFDA published new pricing guidelines in 2021 (implemented 14/01/2021) | A fixed pricing strategy is established for patented products, based on the lowest price identified amongst 20 different countries. The first generic product is priced at 70% of the innovator's product, with subsequent generics decreasing in price by 5% each until the third generic is introduced. From the fourth generic onwards, the price remains fixed. To safeguard the innovator's product price for a period of seven years, even if a generic enters the market, a localization strategy is implemented, effectively fixing the price for that duration. |

| Localization Content & Mandatory List of Products (LCGPA) | Published and updated 2023 | Localization Content allocates a weight of 40% for the local content and for companies listed in the financial market during the evaluation phase of the offers, in addition to a price weight. equivalent to 60%. The mechanism applies to high- value contracts except sourcing contracts. |

| Regional HQ Program in Saudi Arabia | Published by MISA and news 2024 | Saudi Arabia has launched a major tax break for multinational companies setting up regional headquarters (RHQs) in the country, end of 2023. For 30 years, these companies will pay no corporate income tax or withholding tax on approved RHQ activities, starting from the day they get their license |

| The contracting method of Localization of Industry & Knowledge Transfer (LIKT) from (LGCPA) | Article 35 of the Governmental Competition and Procurement Law & Article 58 of the Executive Regulations of the Governmental Competition and Procurement Law | This initiative fosters economic development by localizing industries and transferring knowledge through strategic partnerships. A feasibility study, conducted in collaboration with government entities, determines the optimal approach, potential opportunities, and impact on economic growth. Competition is ensured, considering product specifications, quantities, and local content requirements. A commitment agreement formalizes the partnership, outlining expectations for both parties. The project is closely monitored after signing, culminating in full activation by the government and ongoing performance evaluation. The promising opportunity highlighted is Industry Localization of Reverse Osmosis Membranes, with an expected economic impact of 1.14 billion Saudi riyals and an agreement duration of 8 years. |

Looking Beyond Oil Dependence

The Kingdom of Saudi Arabia is making significant strides in its healthcare and life science sectors, with a strategic emphasis on both domestic needs and international expansion. This ambitious drive, focused on localization and exports, aims to transform the KSA into a regional hub for cutting-edge medical care, life sciences and biotechnology. From bolstering local production of pharmaceuticals and medical equipment to fostering research and development capabilities, KSA is poised to emerge as a key player in the global healthcare landscape. With that being said, several key developments had been done across healthcare and life sciences sectors which clearly indicates that KSA has the potential to emerge as a key global player.

Drug as a top priority: Minister Bandar al-Khorayef emphasizes “localization” (domestic production) of key medicines and creating jobs for Saudis.

Foreign and local: Agreements with Tabuk Pharmaceuticals and SPIMACO aim to localize blood thinners, antibiotics, and other essential drugs. Incentives offered for successful localization.

Biotech ambitions: Building a local bio-manufacturing platform for self- sufficiency, led by the 2024 development of the NBS.

From Clinic to Click: How Saudi Arabia is Transforming Patient Care

Shifting Insurance Market Dynamics, Digital Advancements, Consumer Choice and Behavior, and Local Focus

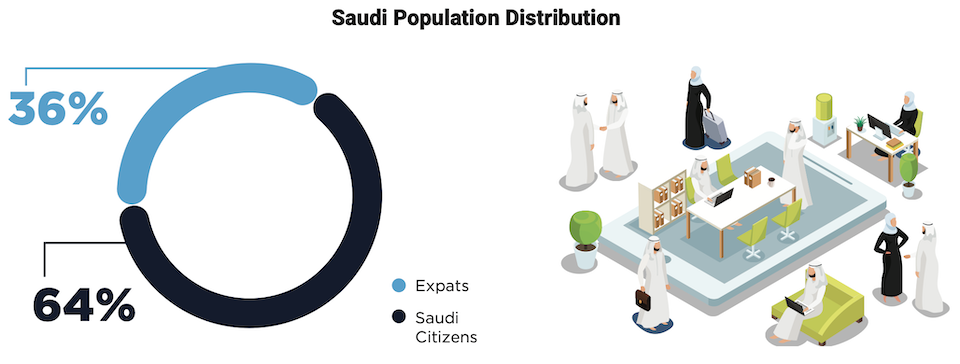

Saudi Arabia’s healthcare landscape is undergoing a remarkable transformation, driven by four key trends: the rise of universal health insurance, evolving consumer behavior, the digital revolution, and a focus on localization. The National Health Insurance scheme, covering all citizens and residents, is creating a stable platform for healthcare delivery. Meanwhile, Saudi consumers are increasingly health-conscious, demanding personalized care, preventive measures, and access to cutting-edge technologies. Digitization is playing a pivotal role, with telemedicine, electronic health records, and AI-powered diagnostics streamlining processes and improving patient outcomes. Finally, the Kingdom is prioritizing localization, building research and manufacturing capabilities in biotechnology to address local health challenges and reduce dependence on imports. This confluence of trends is creating a fertile ground for innovation, attracting global talent and investment, and ultimately, positioning Saudi Arabia as a leading healthcare and life science hub in the region. But how exactly will these trends intersect and influence market dynamics as the Kingdom strives to become a major biotech player by 2030? Which specific initiatives and partnerships are pivotal in realizing this ambitious vision?

1. Shifting Insurance Market Dynamics

The anticipated rise in health insurance is fueled by the mandatory health insurance requirement for all working Saudi citizens, expatriates, their dependents, pilgrims, and visitors to the Kingdom. Most insurance companies within the sector are trying to reduce their reliance on government revenue with the combined factors of mandatory health insurance coverage for all private sector employees, rising disposable income, and government support for privatizing medical services are all anticipated to propel the growth of the health insurance industry. Moreover, the Council of Cooperative Health Insurance (CCHI) expanded the essential benefits package on June 1st, 2022, to include services such as adult vaccinations, telemedicine consultations, post- discharge home care, and knee replacement surgery. In addition, the CCHI insurance drug formula prioritizes generics, with patients able to choose brand names for a co- pay. Doctors typically prescribe generics, dispensed by pharmacists, but patients can choose brand names for a co-pay. Innovative drugs without generic alternatives also have a patient cost, capped at a low amount.

|

Generics First: Doctors must generally prescribe generics, with pharmacists dispensing them unless:

|

|

Out-of-Pocket Costs:

|

2. Digital Advancements

Saudi Arabia’s digital health landscape is primed for explosive growth, fueled by high awareness of established solutions like e-pharmacies and teleconsultations, strong user retention, and surging demand for convenient and time-saving healthcare options. Unfortunately, over half the population lacks awareness of certain solutions, highlighting the potential of education and marketing efforts. Notably, convenience and time-saving benefits top the list of reasons for e-health adoption.

The e-health digitalization is supported by the Saudi government’s proactive approach to digitizing the healthcare system, spearheaded by the comprehensive Digital Health Strategy. Recognizing the potential for improved efficiency, better patient experiences, and enhanced quality of care, the Vision 2030 healthcare transformation plan has laid the groundwork for significant advancements. This includes expanding e-health offerings beyond provider- centric solutions to encompass consumer-facing options like virtual care, a trend accelerated by the COVID-19 pandemic.

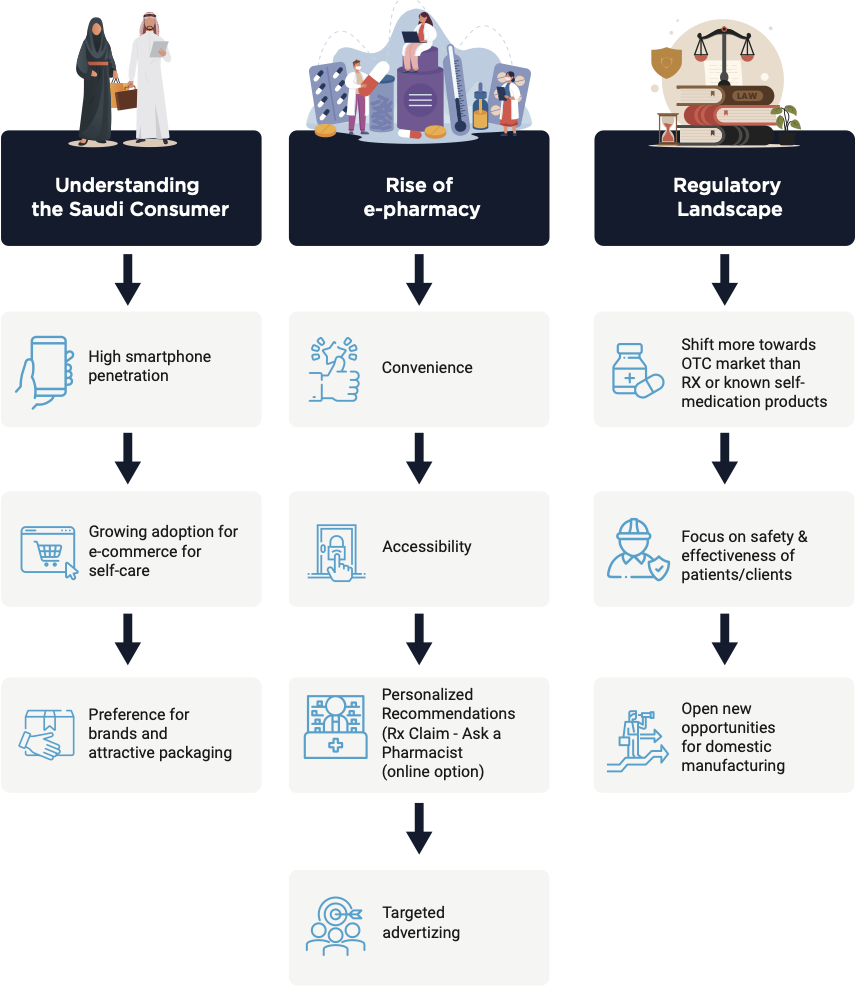

3. Consumer Choice and Behavior

The OTC market in Saudi Arabia is experiencing a dynamic shift, driven by the rise of e-commerce and evolving consumer preferences. While brand recognition and attractive packaging still hold significant weight, the convenience and accessibility offered by e-pharmacies are rapidly changing the landscape.

|

The rise of e-pharmacy: The COVID-19 pandemic served as a catalyst for the e-commerce boom, and e-pharmacies have emerged as a key player in the OTC market. With high smartphone penetration and a growing preference for online shopping, consumers are increasingly turning to e-pharmacies for their self-care needs. This trend is expected to continue, making a robust online presence crucial for brands and retailers. |

|

Brand recognition and packaging: Despite the digital shift, Saudi consumers still prioritize established brands and visually appealing packaging. This presents an opportunity for brands to leverage their existing reputation while incorporating modern design elements to attract online shoppers. |

|

Regulatory landscape: Saudi Arabia is actively reviewing and updating OTC regulations via SFDA to ensure safety and effectiveness while fostering innovation and domestic manufacturing. This changing landscape presents both challenges and opportunities for companies operating in the OTC market. |

|

Rise of proactive patients: There is a change in consumer behaviour (self-care) that is driving the acceptance and penetration of nutraceuticals, vitamins, and preventive treatments. Patients in this market favour branded supplements with visually appealing packaging. |

Navigating the evolving Saudi OTC landscape with a data-driven and consumer-centric approach

4. Local Healthcare & Biotech Focus

The government is actively implementing policies to encourage increased domestic production, knowledge transfer, and job creation. The key drivers and initiatives behind this localization will push its potential impact on the sector and will highlight the opportunities for both domestic and international players.

Several factors are fueling Saudi Arabia’s localization drive in pharmaceuticals and healthcare:

Economic diversification: The Kingdom aims to reduce its dependence on oil exports and develop new industries. Pharmaceuticals and healthcare are identified as strategic sectors with high growth potential.

Knowledge transfer and job creation: The government seeks to attract foreign investment and expertise to transfer knowledge and technologies, creating high-skilled jobs for Saudi nationals.

Import substitution: Saudi Arabia imports a large portion of its pharmaceutical and medical products, creating a significant financial burden. Localization aims to reduce this dependence and boost domestic production.

Improved healthcare access and affordability: Increased domestic production is expected to improve access to essential medicines and medical devices, making them more affordable for citizens.

The Saudi government has launched several initiatives that also support localization in pharmaceuticals and healthcare, including:

Saudi Arabia’s localization is driving the pharmaceuticals and healthcare promises for boosting domestic production, exports, healthcare access, and knowledge transfer. The potential rewards are significant. Accessing a growing market, partnering with local companies for expertise, and contributing to innovation through R&D facilities are some of few opportunities.

Saudi’s Launchpad for Growth as Biotech Hub

Riyadh, fueled by ambition and investment, is aspiring to become a major biotech hub like Boston. This potentially rewarding market for international life science and healthcare companies comes with complexities like unique regulations and practices.

How can foreign investors participate in KSA market

The Saudi Arabian healthcare market is opening its doors to foreign investors through a variety of channels, ranging from full ownership to joint ventures with local companies.

| Solutions | How To Do It | Benefit for Foreign Investors |

|---|---|---|

| Subcontracting | Partner with a local Saudi company to perform specific tasks, like clinical trials or manufacturing components |

|

| White Labelling | License products or technologies to a local company for rebranding and distribution in Saudi Arabia |

|

| Joint Venture | Establish a new company co-owned by the foreign company and a local Saudi partner |

|

| Merger & Acquisition (M&A) | Acquire an existing Saudi company in the life science or healthcare sector |

|

| Direct Investments | Set up a subsidiary or branch in Saudi Arabia to fully control operations either through a local entity or Regional HQ to benefit from additional local Saudi services |

|

| Technology & Knowledge Transfer | Share expertise and technology with local companies through licensing, training, or R&D collaboration |

|

| Research & Development (R&D) | Conduct joint research and development activities with Saudi institutions or companies |

|

| Localization Of Manufacturing Or Services | Establish production facilities or service centers in Saudi Arabia |

|

Can Riyadh become the next Boston?

The potential is there. KSA has an enormous level of government support, is an extremely attractive environment for international investors and has already managed to position itself as a global leader in other sectors in a short space of time. However, challenges remain. Biotechnology is heavily dependent on talent and the ability to conduct and commercialize ground breaking R&D. The development of this sector will take some time and the market must be closely monitored.

The Authors

Damien Duhamel

Damien Duhamel

Managing Partner, Eurogroup Consulting Middle East

Jack Fowler

Jack Fowler

Director, Eurogroup Consulting Middle East

Josephina Mallah

Josephina Mallah

Consultant, Eurogroup Consulting Middle East