The Seha Saudi Arabia timeline marks a major point in the country’s health reform. The Ministry of Health has now transferred assets to the Health Holding Company, opening 290 hospitals for Private Sector Participation. This shift is part of a larger plan to modernize care, raise efficiency, and expand private investment under Vision 2030. Seha’s rapid growth, especially through the Seha Virtual Hospital launched in 2022, shows how digital tools are changing the system. Outpatient visits rose from 1,717 in 2021 to 27,896 in 2024, with patient satisfaction steady at 86%.

Seha Saudi Arabia Timeline: The Rise of the Cluster Model

A major part of this transformation is the cluster structure. The system now operates through 21 health clusters, each responsible for its own planning, spending, and performance. These clusters act like independent networks, coordinating primary, secondary, and tertiary services.

Clustered hospitals reported stronger care coordination, better digital engagement, and clearer accountability. The E1-Clusters gained more autonomy, which helped them improve operations faster than non-clustered hospitals. Competition with private providers increased, but so did cooperation across the clusters as they learned from each other.

Read Also: Sehhaty Hits 31M Users in Saudi Digital Health Push

Insurance Reform: How Mandatory Coverage Shifts Revenue

Mandatory insurance is reshaping incentives across the system. Private hospitals see rising revenue as more patients are covered under new insurance rules. This shift matters in a country where households recorded 18,540 SR billion in out-of-pocket spending in 2020 — around 11% of total health expenditure.

The reform aims to move the system toward equity and predictable financing. But it also brings challenges. Private hospitals must balance rising demand with cost-effectiveness, quality standards, and new performance contracts linked to outcomes.

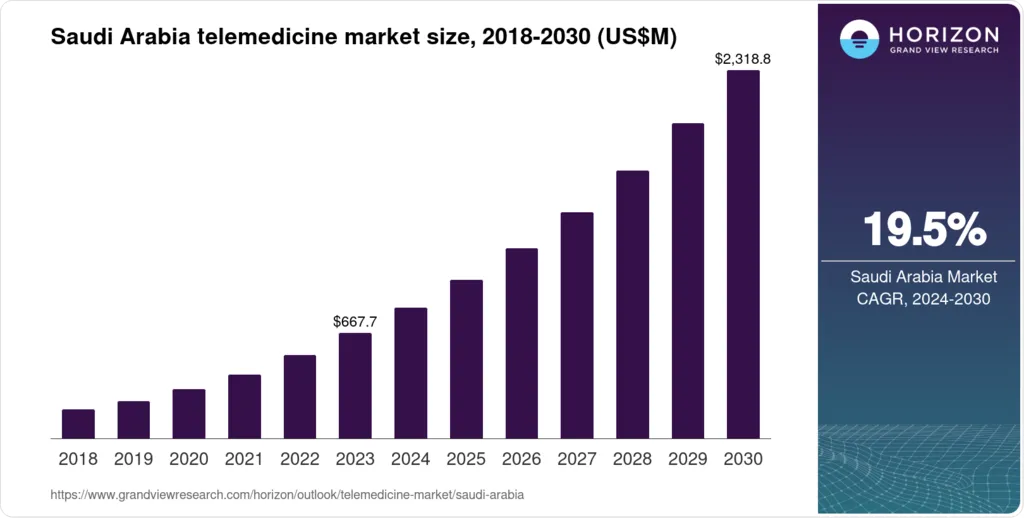

Digital First: A $1.5B Leap Toward Virtual Care

Digital care is another major pillar in the Seha Saudi Arabia timeline. Saudi Arabia committed $1.5 billion to telemedicine, EMRs, AI tools, and mobile apps. The Seha app alone delivered 1,877,440 e-consultations in early 2020. Virtual visits made up 2% of primary care interactions as early as 2018.

The Seha Virtual Hospital reflects the scale: by 2022, it connected 130+ hospitals across 12 specialties and served 500,000 beneficiaries annually. Oncology cases increased from 24 to 714, while stroke cases jumped from 41 to 4,393. Despite this surge, patient satisfaction stayed high. Digital care is now firmly integrated into the national model.

Read Also: Rolling Clinics: Saudi Mobile Healthcare’s Reach

A New Era for Seha Saudi Arabia Timeline

Privatization 2.0 is more than an ownership shift. It blends PSP, digital-first systems, mandatory insurance, and autonomous clusters into one coordinated framework. The goal is clear: improve quality while expanding private participation across all levels of care. This reform wave, as mapped in the Seha Saudi Arabia timeline, invites companies, investors, and partners to explore new opportunities in a fast-growing sector. To understand these developments and succeed in Saudi Arabia’s evolving market, contact Saudi Arabia Healthcare by Eurogroup Consulting. With 40 years of excellence in strategic consulting and deep expertise in market research, the firm offers unmatched insights for navigating the Kingdom’s dynamic healthcare landscape.