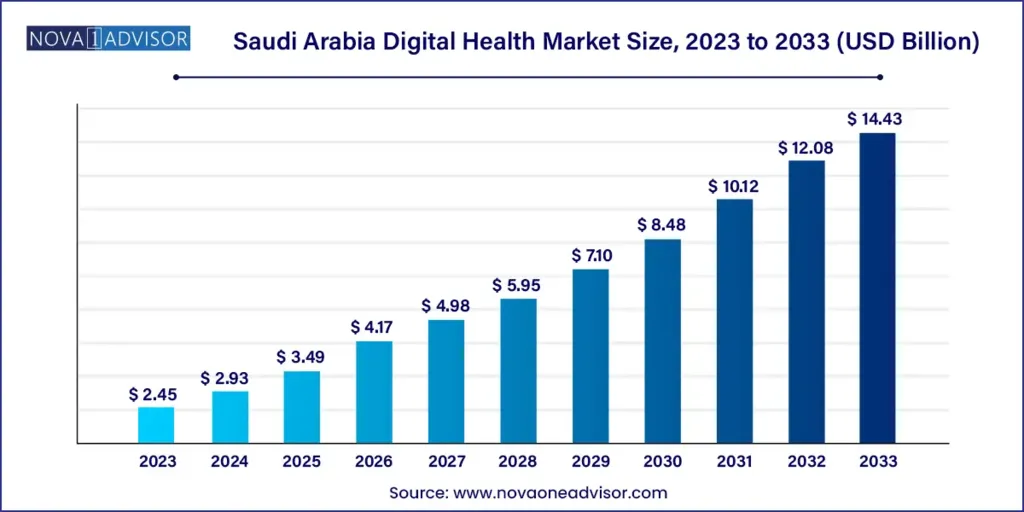

Saudi HealthTech Market Outlook: Poised to Hit $14.43B by 2033

Saudi Arabia’s healthcare sector is undergoing a digital renaissance, fueled by Vision 2030 and a tech-savvy population. The Saudi HealthTech Market is projected to grow from USD 2.93 billion in 2024 to USD 14.43 billion by 2033, marking a robust CAGR of 19.4%. Rather than simply digitizing infrastructure, this evolution marks a fundamental redesign of patient-centered care pathways.

Tele-healthcare Leads with 45.9% Market Share in 2023

In 2023, tele-healthcare emerged as the dominant technology segment, capturing over 45.9% of the market. Platforms like Sehha and Mawid have become household names, enabling millions to consult physicians remotely. From video consultations to remote medication management, telehealth is now a cornerstone of Saudi Arabia’s healthcare strategy.

Meanwhile, mHealth is gaining momentum as the fastest-growing technology. With high smartphone penetration and rising health awareness, wearables and Arabic-language fitness apps are becoming mainstream, especially among urban youth.

Services Dominate, But Software Is Catching Up Fast

Services held the largest revenue share in 2023, thanks to their critical role in enabling diagnostics, monitoring, and teleconsultation. Hospitals and insurers alike are partnering with service providers to deliver AI-powered imaging and chronic care management.

However, software is the fastest-growing component. SaaS-based platforms for electronic medical records (EMRs) and clinical decision support are being rapidly adopted, especially by mid-sized hospitals seeking scalable, cost-effective solutions.

Diabetes Drives Demand, Obesity Surges Ahead

Diabetes accounted for 30.12% of the market in 2023, reflecting its widespread prevalence and economic burden. Digital dashboards, glucose monitors, and lifestyle coaching apps are now standard tools in managing diabetic care.

Obesity, however, is the fastest-growing application. Public health campaigns and fitness tech adoption have spurred demand for weight management apps that offer meal tracking, virtual coaching, and smartwatch integration, all tailored to Saudi cultural preferences.

Patients Lead Usage, Providers Accelerate Adoption

Patients represented the largest end-use segment in 2023, with over 30.18% market share. The convenience of remote care, especially for non-urgent conditions, has made digital health tools indispensable. Insurance coverage and intuitive app design have further boosted patient engagement.

Providers, on the other hand, are the fastest-growing users. Hospitals are investing in AI triage systems, EHR integration, and digital innovation labs to streamline operations and enhance diagnostics.

Urban-Rural Divide Shapes Saudi HealthTech Market Growth

Major cities like Riyadh, Jeddah, and Dammam are leading the charge in digital adoption. Private clinics offer comprehensive telehealth packages, and urban residents are quick to embrace wearables and health apps.

Rural areas, while slower to adopt, are catching up through MOH-led mobile health units and teleconsultation outreach. The National eHealth Strategy aims to unify health data across regions, ensuring equitable access to digital care.

Recent Milestones Signal Market Maturity

- March 2025: Tawuniya launched an AI platform for chronic disease management.

- January 2025: King Faisal Hospital deployed AI imaging for early tumor detection.

- October 2024: Sehhaty added virtual mental health consultations.

- August 2024: STC Health and Samsung partnered to bundle smartwatches with preventive health apps.

These developments underscore the Saudi HealthTech Market’s shift from experimentation to large-scale implementation.

Vision 2030: The Engine Behind HealthTech Expansion

At the heart of this transformation is Vision 2030, Saudi Arabia’s blueprint for economic diversification and public service modernization. With national platforms like Sehhaty and Mawid reaching millions, and the upcoming National Platform for Health Information Exchange (NPHIE) promising seamless data sharing, the Saudi HealthTech Market is primed for exponential growth.

Challenges Remain: Digital Literacy and Cultural Sensitivity

Despite progress, digital literacy gaps, especially among older citizens and rural populations, pose adoption challenges. Cultural norms around teleconsultation, privacy, and gender dynamics also influence utilization. Addressing these barriers will be key to unlocking the full potential of the Saudi HealthTech Market.

Also Read: Saudi HealthTech Gets Clinical with AI-Led Hospital Adoption