$65B Investment to Transform 290 Hospitals and 2,300 Clinics

At the core of Saudi Healthcare Privatization is a sweeping commitment: a $65 billion investment aimed at transforming the country’s entire healthcare landscape. This includes the privatization of 290 hospitals and 2,300 primary health centers, supported by the creation of 21 integrated health clusters and a bold push into e-health infrastructure. These numbers reflect a systemic reform toward accessible, tech-enabled, and prevention-focused care, setting new benchmarks for both regional and global healthcare systems.

PPP Investment Fuels Innovation in Healthcare Delivery

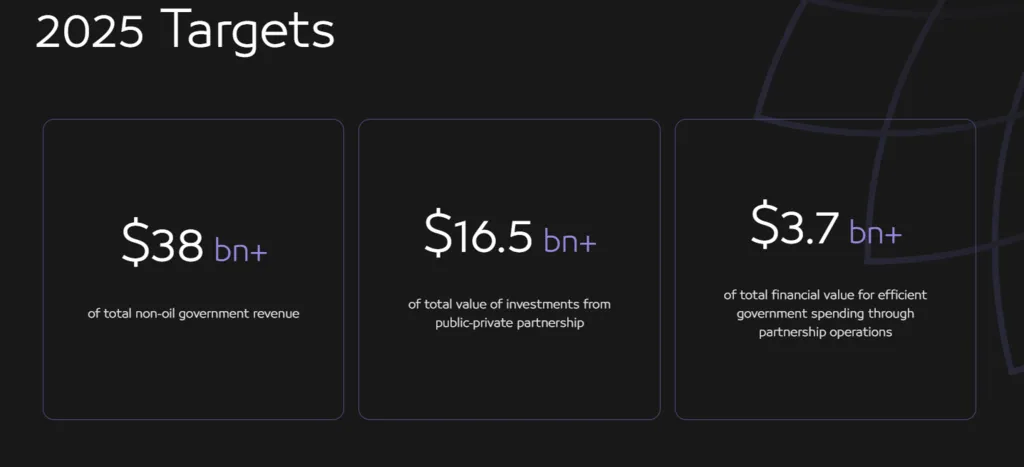

Within this broader transformation, the Privatization Programme sets an additional $16.5 billion target for public-private partnerships (PPPs), accelerating private sector participation. By steering strategic capital into infrastructure and service delivery, Saudi Healthcare Privatization is emerging as a flagship area within this national agenda, primed to redefine access, affordability, and quality of care.

Unlocking State Assets to Boost Saudi Healthcare Privatization

One of the core objectives of the Privatization Programme is to unlock state-owned assets. In healthcare, this means giving private entities access to hospitals, diagnostic facilities, and even administrative health services. Such moves help accelerate Saudi Healthcare Privatization efforts while stimulating competition, which often leads to innovation in service delivery, digital health solutions, and patient-centered care models.

Cost Savings and Quality Gains Through Service Transfers

Healthcare privatization is expected to contribute significantly to efficient government spending, which is projected to yield over $38 billion in value by 2025. Through strategic outsourcing and privatizing non-core services such as facility management, diagnostics, and IT systems, the Ministry of Health can shift its focus to regulatory oversight and national health strategy. This not only reduces expenditure but also elevates the quality and consistency of care.

Legal and Institutional Frameworks Enhance Private Sector Confidence

The Saudi Privatization Law, enacted recently, provides a clear legal foundation for private investors. Complemented by the National Center for Privatization (NCP), these frameworks streamline licensing, procurement, and asset transfer. For stakeholders in Saudi Healthcare Privatization, such structure minimizes risk while maximizing return potential, encouraging greater cross-border and domestic investment.

Building Human Capital and Technological Infrastructure

Privatization is not just about assets—it’s also about people and platforms. With private companies stepping in, there’s a surge in demand for health professionals, data analysts, and tech specialists. This creates employment opportunities while pushing the sector toward AI-driven diagnostics, telemedicine, and personalized treatment. As Saudi Arabia continues this transformation, Saudi Healthcare Privatization is becoming a beacon for scalable innovation across the GCC.

Expanding Access Through Local and Foreign Private Investment

As the Kingdom accelerates Saudi Healthcare Privatization, it is also actively courting both domestic and international investors to bridge service gaps in underserved regions. By decentralizing investment opportunities—especially in Tier 2 and Tier 3 cities—Saudi Arabia is unlocking latent healthcare demand and encouraging the development of specialized clinics, telehealth hubs, and mobile medical units. This regional focus ensures that the benefits of privatization extend beyond urban centers, aligning with Vision 2030’s broader mandate of equitable healthcare access and inclusive economic growth. The strategy not only bolsters investor confidence but also reinforces healthcare resilience nationwide.

Also Read: Saudi Healthcare Sector Investment and Trends in 2025