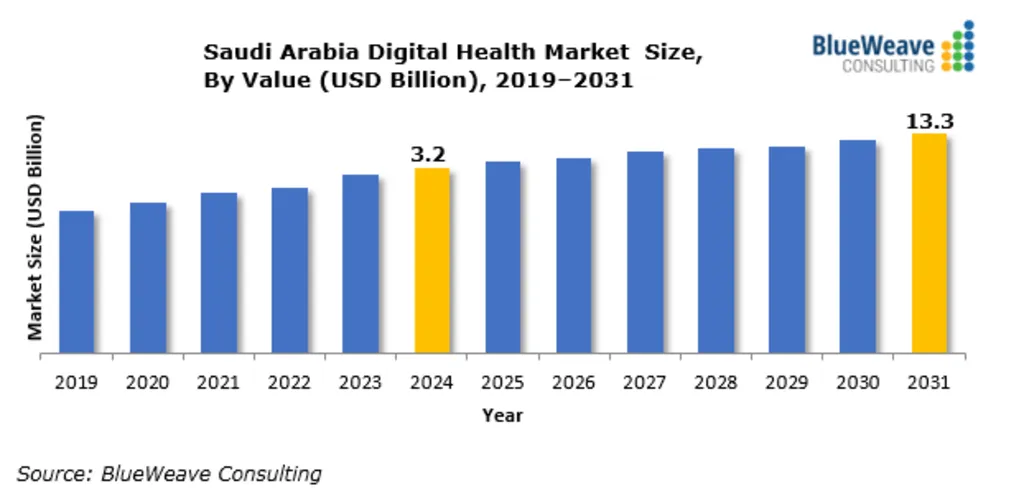

$3.2B Market Fuels Saudi HealthTech Integration in Hospitals

In 2024, Saudi Arabia’s digital health market hit $3.2 billion. A figure that speaks volumes about more than just investment. It marks a turning point in how hospitals across the Kingdom think about care. From Riyadh to remote regions, healthcare providers are embracing Saudi HealthTech platforms that do more than digitize, they personalize.

Seha Virtual Hospital Sets Benchmark for AI-Driven Care

At the forefront of this transformation is the Seha Virtual Hospital, a fully digital facility that exemplifies the convergence of AI and telemedicine. By linking specialists across locations and deploying AI-assisted diagnostics, Seha has become a blueprint for scalable virtual care. Its modular infrastructure allows hospitals to adopt individual capabilities, such as e-ICU, digital prescriptions, and remote triage, without overhauling entire systems. This flexibility is accelerating Saudi HealthTech adoption across both public and private sectors.

21.3% CAGR Signals Rapid Expansion Through 2031

With a projected compound annual growth rate of 21.3% through 2031, Saudi Arabia’s digital health sector is one of the fastest-growing in the region. Hospitals are investing in AI-powered platforms not only to improve clinical outcomes but also to optimize operational efficiency. From outpatient consultations to emergency department workflows, AI is helping reduce bottlenecks and improve throughput. The result is a more resilient and responsive healthcare system.

AI-Enhanced Diagnostics Boost Accuracy and Early Detection

One of the most prevalent applications of Saudi HealthTech in hospitals is AI-based image analysis. Tools that scan X-rays, MRIs, and CT scans are now capable of detecting anomalies with extraordinary precision, often earlier than traditional methods. This has profound implications for early intervention and long-term patient outcomes. Hospitals using these platforms report improved diagnostic accuracy and reduced time-to-treatment, especially in radiology and oncology departments.

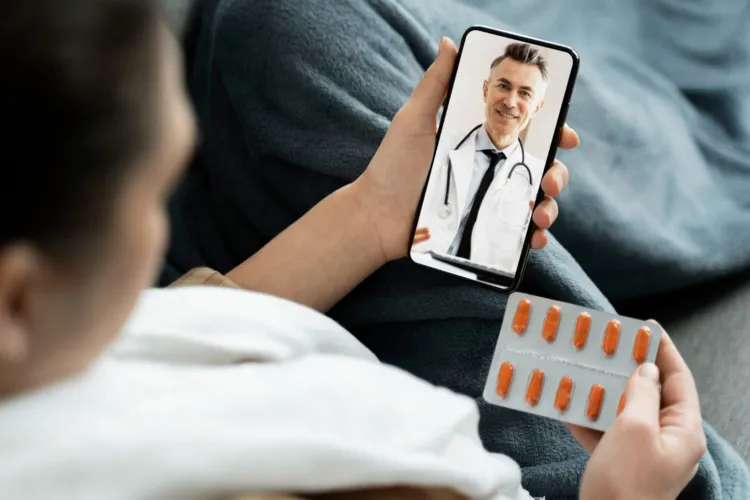

Telemedicine Platforms Ease Access and Reduce Strain

High smartphone penetration and widespread internet access have made telemedicine a viable solution for hospitals managing large patient volumes. Platforms like Cura and Babylon Health offer AI-assisted symptom checkers and remote consultations, helping hospitals triage cases more effectively. This reduces unnecessary visits and allows specialists to focus on high-priority cases. For rural and underserved regions, Saudi HealthTech platforms are bridging access gaps that physical infrastructure cannot.

Predictive Modeling and Wearables Enter Clinical Workflows

Hospitals are beginning to integrate predictive modeling and wearable data into their clinical workflows. Platforms like Nala, which sync with wearables to monitor vital signs, are being used to flag potential health risks before symptoms escalate. This proactive approach is shifting hospitals from reactive treatment to preventive care. As these tools become more embedded, Saudi HealthTech is expected to redefine chronic disease management and post-operative monitoring.

Infrastructure Commercialization Accelerates Private Sector Uptake

The success of public initiatives like Seha Virtual Hospital is catalyzing private sector adoption. By commercializing infrastructure capabilities such as AI diagnostics and virtual triage, Saudi hospitals can scale digital health solutions without duplicating investment. This diffusion model is helping smaller hospitals and clinics access cutting-edge Saudi HealthTech tools, leveling the playing field across the healthcare landscape.

Regulatory Vigilance and Ethical AI Remain Critical

Despite rapid adoption, benchmarking tools for AI systems remain limited. Hospitals must navigate ethical considerations, especially around bias and algorithmic transparency. Experts emphasize the need for “algorithm vigilance” or regular monitoring to ensure safe and equitable use. As Saudi HealthTech platforms become more autonomous, particularly in elder care and low-risk environments, regulatory clarity will be essential to maintain trust and safety.

Also Read: How to Choose the Right Medical Devices Distributor in Saudi Arabia

Frequently Asked Questions (FAQ)

1. What is driving the adoption of Saudi HealthTech in hospitals?

The primary drivers include a $3.2 billion digital health market (as of 2024), high smartphone penetration, and government-backed initiatives like Vision 2030. Hospitals are adopting Saudi HealthTech to improve access, efficiency, and clinical outcomes.

2. How are Saudi hospitals using AI in clinical settings?

AI is being used for diagnostics, image analysis (e.g., X-rays, MRIs), triage, and predictive modeling. These tools help detect diseases earlier, reduce diagnostic errors, and streamline patient flow, especially in emergency and outpatient departments.

3. What is the role of Seha Virtual Hospital in Saudi HealthTech?

Seha Virtual Hospital is a flagship digital facility that connects specialists across locations and uses AI for diagnostics and remote consultations. It serves as a scalable model for other hospitals to adopt modular HealthTech capabilities.

4. Are private hospitals also adopting digital health platforms?

Yes. Public sector innovations like Seha are being commercialized, allowing private hospitals and clinics to integrate AI-driven diagnostics, virtual consultations, and digital prescriptions without building infrastructure from scratch.

5. What challenges remain in implementing Saudi HealthTech?

Key challenges include the need for regulatory clarity, ethical AI use, and robust benchmarking tools to evaluate system performance. Ensuring algorithm transparency and minimizing bias are also critical for safe clinical deployment.