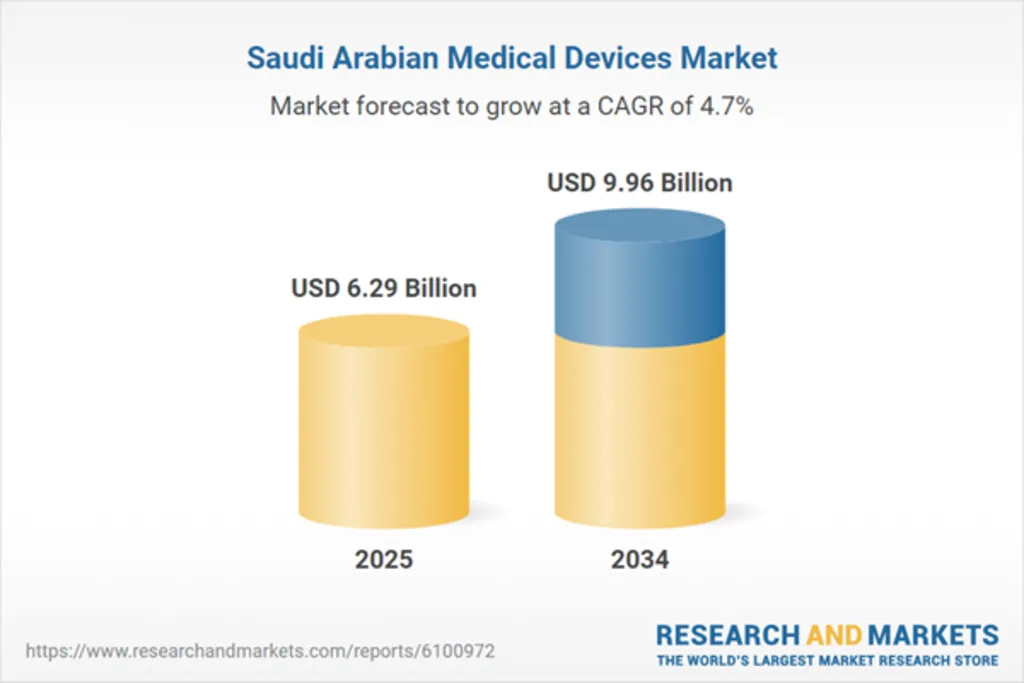

Market Valuation: From USD 6.29 Billion to Nearly USD 10 Billion

The Saudi Medical Devices market is entering a decade of steady expansion. Valued at USD 6.29 billion in 2024, the sector is projected to reach USD 9.96 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.7%. This growth trajectory is underpinned by demographic shifts, including an aging population and rising chronic disease prevalence, which are driving demand for advanced healthcare solutions.

Vision 2030 and Digital Health Investments Fuel Expansion

Saudi Arabia’s Vision 2030 strategy is a cornerstone of this market’s momentum. With USD 1.5 billion earmarked for health technology, the Kingdom is accelerating digital health adoption. Investments in telemedicine, electronic health records, and AI-powered diagnostics are reshaping patient care delivery. These initiatives not only improve efficiency but also enhance patient outcomes, making Saudi Arabia a regional leader in digital health integration.

Regulatory Reforms Boost Investor Confidence

The Saudi Food and Drug Authority (SFDA) has introduced frameworks such as the MDS-G010 guidance, which governs AI- and machine learning-enabled medical devices. By aligning local regulations with international standards, Saudi Arabia is creating a transparent and innovation-friendly environment. This regulatory clarity is a magnet for global investors, ensuring that Saudi Medical Devices remain competitive on the international stage.

Product Segmentation: Orthopedic and Cardiovascular Devices Lead

The market spans a wide range of products, from diagnostic imaging and respiratory devices to orthopedic and cardiovascular equipment. Among these, orthopedic and cardiovascular devices are experiencing the fastest growth, driven by lifestyle-related diseases and the government’s investment in specialized treatment centers. The demand for critical care and surgical devices is also rising, particularly in urban hospitals and specialty clinics.

End-User Dynamics: Hospitals Dominate, Homecare Rising

Hospitals remain the largest end-users, supported by significant government spending on healthcare infrastructure. However, homecare devices are gaining traction, reflecting a global shift toward remote monitoring and personalized care. This trend is particularly relevant in Saudi Arabia’s urban centers, where patients increasingly seek convenience and continuity of care outside traditional hospital settings.

Regional Insights: Riyadh, Makkah, and Eastern Province Drive Growth

- Riyadh: The capital leads in adoption, thanks to advanced healthcare facilities and concentrated investment.

- Makkah & Madinah: Medical tourism is fueling demand, especially for specialized treatments.

- Eastern Province: Oil wealth supports large-scale healthcare projects.

- Qassim: Government-backed initiatives are ensuring steady, if slower, expansion.

This regional diversity highlights the broad opportunities for Saudi Medical Devices across both urban and semi-urban markets.

International Expansion: Global Players Strengthen Competition

The Saudi market is increasingly attractive to multinational corporations. Companies like Medtronic, Johnson & Johnson MedTech, Abbott, GE Healthcare, Philips, Siemens, and 3M are expanding their presence. For example, Lepu Medical’s 2021 authorization to market PCI products marked a significant step in cardiovascular innovation. Such international collaborations not only increase competition but also accelerate technology transfer and local manufacturing capabilities.

Growth Drivers: AI, Telemedicine, and Public-Private Partnerships

Three key drivers stand out:

- AI Integration: Enhances diagnostics, predictive care, and device efficiency.

- Telemedicine: Expands access to healthcare, particularly in underserved regions.

- Public-Private Partnerships (PPPs): Encourage local manufacturing and reduce reliance on imports.

Together, these drivers ensure that Saudi Medical Devices will continue to evolve in line with global healthcare trends while maintaining a strong domestic foundation.

Outlook: A Market Nearing USD 10 Billion by 2034

The next decade will see Saudi Arabia transform into a hub for medical technology in the Middle East. With nearly USD 10 billion in market value projected by 2034, the Kingdom is positioning itself as both a consumer and producer of cutting-edge medical devices. For investors, manufacturers, and healthcare providers, the message is clear: the Saudi Medical Devices market offers not just growth, but long-term strategic opportunity.

Also Read: How to Choose the Right Medical Devices Distributor in Saudi Arabia